when is tax return season 2022

Ad File a Late 2021 Tax Return Directly to the IRS. 65 or older.

Easy Steps Taxpayers Can Take Now To Make Tax Filing Easier In 2022 Signals Az

In addition while last years tax credit was fully refundable the 2022.

. 29 June 2022 The South African Revenue Service SARS has made significant changes to the 2022 Tax Filing Season. Deadline to file your 2021 tax return or request a six-month extension though youll still need to. The tax year 2023 adjustments described below generally apply to tax returns filed in 2024.

The US Tax Filing Deadline was April 18 2022. Impacts to Child Tax Credit Payments. Getting ready for the 2022 tax season.

The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code. Married filing jointly. Tax-return reporting has changed yet again for the 2022 tax season.

The deadline to file your tax return is inching closer. You need to know the amount of your third stimulus payment you received in 2021 for yourself spouse or. Tax-return reporting has changed yet again for the 2022 tax season.

A couple at 500000 of income would see their tax. 2 days agoSenate President Karen Spilka said the return 3 billion in tax rebates and its effect on revenue have made talks even more complicated. Throughout 2021 millions of parents received monthly payments from the IRS.

This year over 3 million individual non-provisional taxpayers have. But not more than 3950 an increase of 250 from tax. A married couple with taxable income of 200000 in both 2022 and 2023 would see a reduction in their tax of nearly 900.

There are seven federal income tax rates in 2023. For your 2022 tax return the potential return per dependent aged 16 or younger scales back down to the original 2000. Its the start of another tax season and while many preparers are cautiously optimistic that this year will mark a return to some sort of.

Get Your Past-Due Taxes Done Today. 1 July 2022 to 24 October 2022. If your 2021 gross income exceeds the amount shown in the table above you must file a federal income tax return.

IR-2022-08 January 10 2022. Tax season 2022 has arrived. Prepare and eFile your IRS and State 2021 Tax Returns by April 18 2022.

How the 2022 Tax Filing Season Was Different. The Internal Revenue Service starts accepting and processing 2021 tax returns Monday Jan. WASHINGTON The Internal Revenue Service today encouraged taxpayers to take important actions this month to help them file their federal tax returns in 2022 including.

If you had income in 2021 from equity compensation whether from stock option exercises restricted. 24 17 days earlier than last tax seasons late start. Income tax return filing dates.

If you miss this deadline you have until October 15 October 17. The IRS defines gross income as all. Taxpayers who cannot file online can do so at a SARS branch by appointment only.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Problems that only snowballed amid the pandemic and led to a backlog of 24 million unprocessed tax returns at the start of. Taxpayers who file online.

File Your Tax Return for Free. The start of this years tax season which takes place earlier than last years February 12 opening signals the IRS is now accepting and processing 2021 tax returns. The 2021 eFile Tax Season starts in January 2021.

If you had income in 2021 from equity compensation whether from stock option exercises restricted. For taxpayers expecting refunds tax season couldnt come soon enough. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for.

Planning for the nations filing season process is a massive undertaking and IRS teams have worked non-stop getting ready for the 2022 filing season. The 2022 tax return filing season for individual and trust taxpayers is well underway with the first submission due date now in October 2022. 0 Federal 1499 State.

April 16 2022 709 AM 2 min read. Key dates and deadlines to remember April 18. Up 200 from tax year 2022.

WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Monday January 24 2022 when the tax. These payments were prepaid installments on the. 2022 tax season calendar.

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

How To File Taxes For Free In 2022 Money

Start Of 2022 Tax Filing Season Set When Is Tax Filing Deadline Syracuse Com

Estimated Income Tax Payments For 2022 And 2023 Pay Online

2022 Tax Filing Opens Monday Afsg Consulting

Income Tax Season 2022 What To Know Before Filing In California Across California Ca Patch

The Irs Is Buried In Paper Why It Matters For The 2022 Tax Season

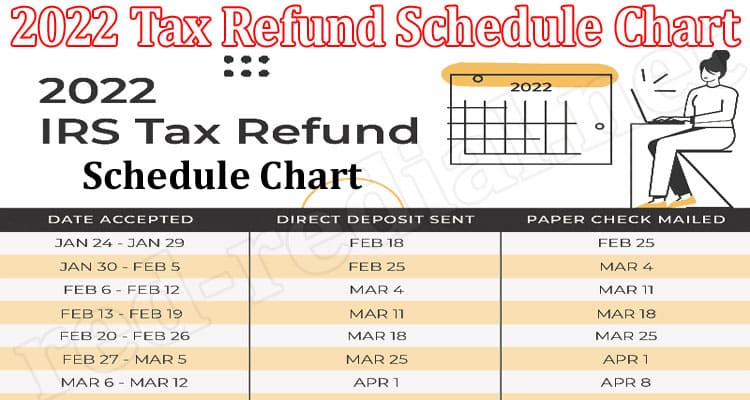

2022 Tax Refund Schedule Chart Mar A Precise Info

Tax Season 2022 What You Need To Know Doral Family Journal

Tax Season Is Here How To Prepare In 2022 Nextadvisor With Time

Tax Season 2022 Update How To Get Your Refund Sooner 19fortyfive

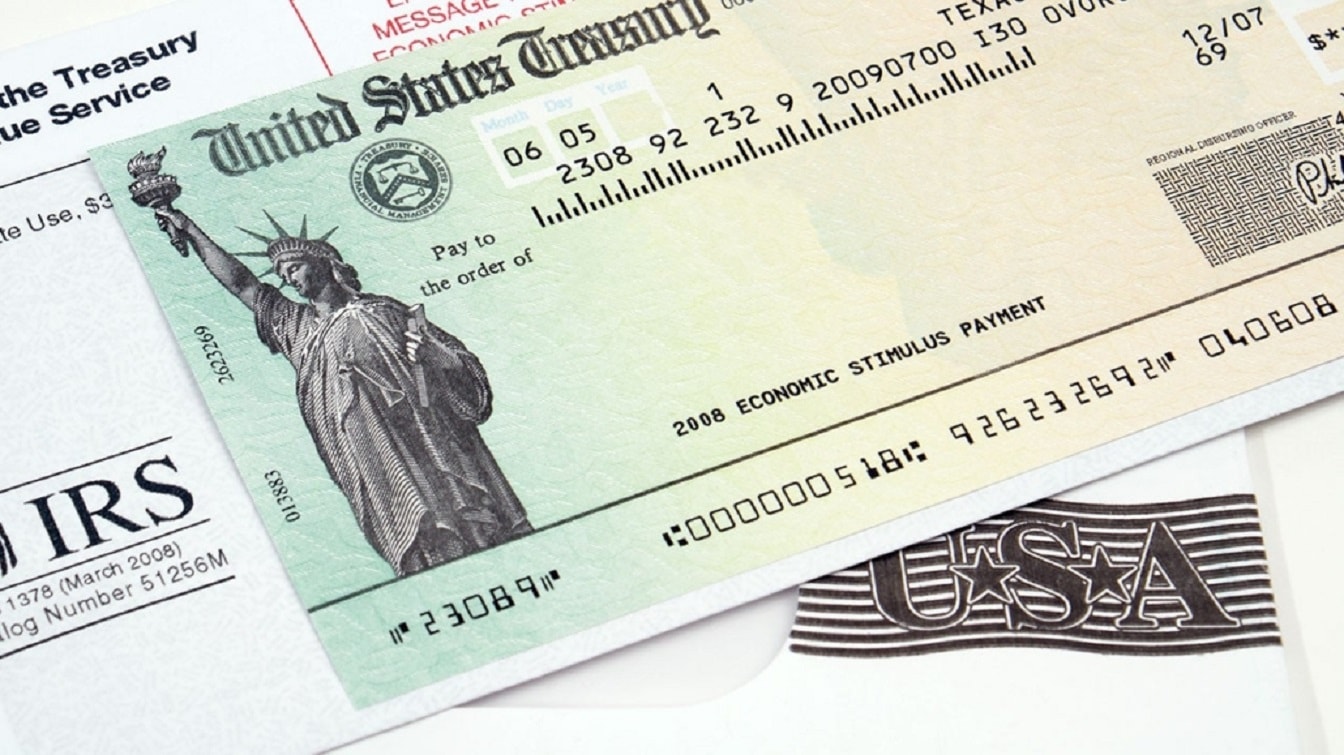

H R Block Tax Refund Emerald Advance Loan For 2022 2023

Prepping For Tax Season 2022 Accounting Today

Federal Tax Filing Season Has Started Access Wealth

Irs Announces 2022 Tax Filing Start Date

When Will The Irs Start Accepting Tax Returns In 2022

When To Expect Your 2022 Irs Income Tax Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)